- November 22, 2024

-

-

Loading

Loading

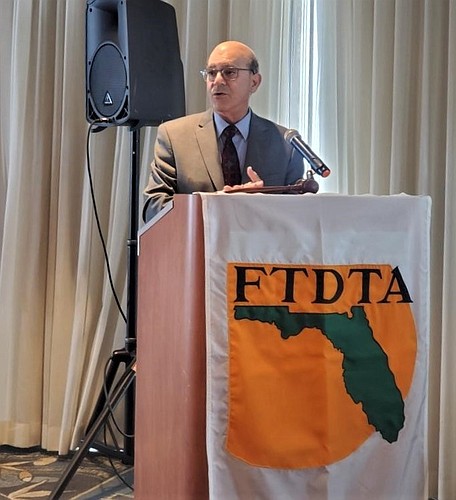

Among the presenters at the Florida Tourist Development Tax Association statewide conference, held Wednesday through Friday, July 28-30, were Flagler County Attorney Al Hadeed, as well as Shelly Edmonson, Renee Flynt, and Amy Rader, who work for the Tax Collector’s Office in the specialty tax department.

Hadeed, who presented on Thursday, provided an update on Legislation Session House Bill 219 and Senate Bill 522. He is known for taking Flagler County’s case to the Florida Legislature to restore home rule authority over short-term vacation rentals, and the legislation that was successfully enacted in 2014 to reinstate local government regulatory authority. The county then used that authority to create an ordinance that has been a model for many local governments across the state.

“I discussed the legislative attempts last session addressing short term rentals,” Hadeed said. “No legislation actually passed, but it is relatively certain that Airbnb – and the other platforms – will be back to change the law that Flagler secured in 2014 with the help of numerous cities and counties.”

“Home Rule” is not only important to Flagler County, but to all local governments at the county and municipal level. Historically, it’s been a topic of discussion for centuries going back to the 10th Amendment of the U.S. Constitution.

“Home Rule authority is critical for every local government. It is grounded in the State and U.S. Constitutions,” said Commission Chairman Donald O’Brien. “The ability to enact ordinances, codes, plans, and resolutions, that are reflective of the will of local citizens, without prior state approval, is essential.”

The Florida League of Cities has on its website a document “Understanding Florida’s Home Rule Power” to provide a concise overview.

“In Florida, Home Rule language was proposed in the 1968 Constitutional revision, and was adopted by the people,” it states. “After several legal challenges, the Legislature adopted the Home Rule Powers Act in 1973, which ended challenges related to city and county powers.”

The Florida Constitution states in Article VIII, Section 1(f): “Counties not operating under county charters shall have such power of self-government as is provided by general or special law.”

Despite the weighty topics of the conference, the team from Flagler County Tax Collector’s Office took a light-hearted approach to testing everyone’s knowledge about Tourist Development Tax.

“The team from the Tax Collector’s Office did a marvelous job with their ‘Wheel of Fortune’ feature at the conference,” Hadeed said. “It tested the knowledge of attendees on tax collection questions placed on the spinning wheel.”

During the conference, Edmonson was elected president of the Florida Tourist Development Tax Association. Flynt currently serves as the Chairwoman of the Florida Tax Collector's Statewide Tourist Tax Coalition.

“We are truly honored to represent Flagler County and serve on these boards, that provide continued education, communication and collaboration to Tax Collector Offices, Clerk of Court and Comptroller Offices, across the State of Florida,” Edmonson said.

Flynt added, “Tourist tax collection is a vital process for our communities.”

Both woman are native to Flagler County, and have achieved the following titles: Certified Florida Collector Assistant; Certified Business Tax Official; Certified Executive Leader with Valencia College; and, graduates of the Inaugural Flagler County Leadership Academy.