- January 16, 2025

-

-

Loading

Loading

Flagler County commissioners have slightly lowered the county's property tax rate for the coming year. But because of rising property values, the slightly lowered rate is still an overall tax increase: It will bring the county more tax revenue in the coming year than the county received this year.

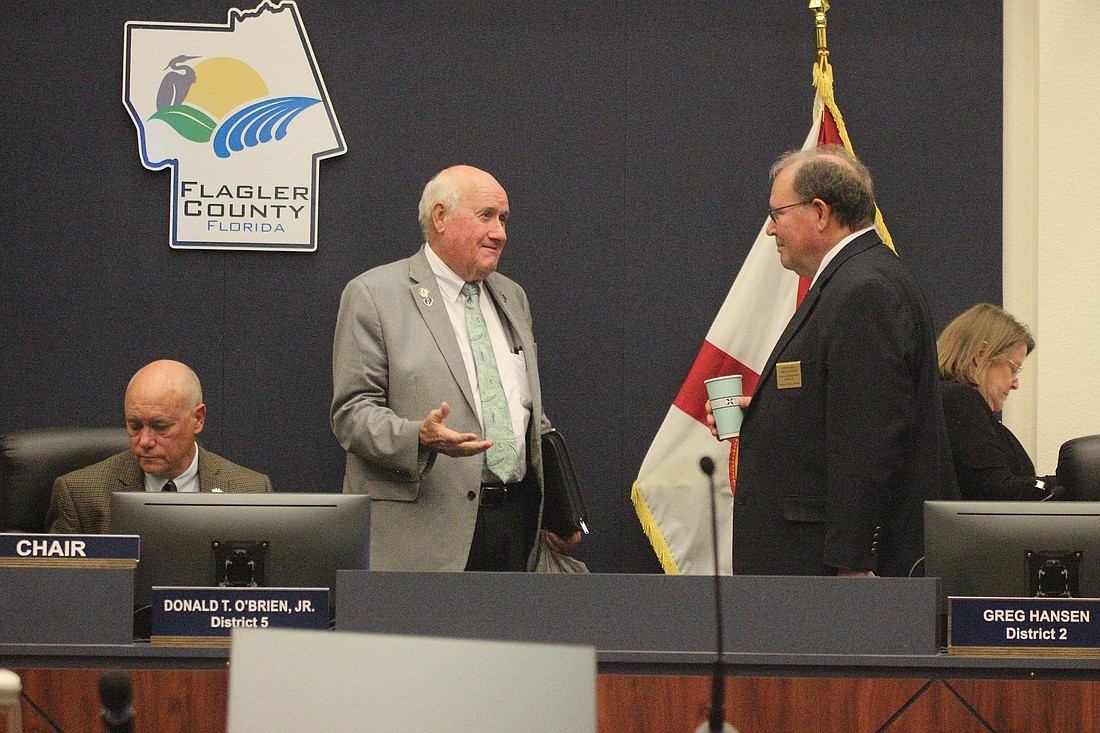

Commissioners approved the new rate of $8.4847 per $1,000 of taxable value, or 8.4847 mills, during a public hearing on Sept. 20.

The current rate is $8.5847 per $1,000 of taxable value, or 8.5847 mills, including debt service millage and environmentally sensitive lands bonds as well as operating millage. The operating millage rate commissioners approved is 3.91% over the rollback rate — the rate that would bring in the same dollar amount of tax revenue as the county received in the current year.

Property values have risen by 9% in Flagler County, and the coming year's millage rate is expected to bring in $5.9 million more in taxes in the coming year.

For a $200,000 house with $150,000 in taxable value, the slightly lowered rate would save $15 over what the homeowner would have paid if the commission had opted to maintain the current year's rate — $1,272.71 at the 8.4847 mill rate, versus $1,287.71 if the rate had remained 8.5847.

The commission also unanimously approved the county's $221,094,445 budget for the coming year. The budget is an increase of $1,229,376 over the current year's budget.

No residents spoke during the meeting's public comment periods.