- December 15, 2025

A new study on bringing a proposed 180-acre sports complex to Palm Coast estimates that a facility of that size could generate an economic impact of over $79 million in its first year alone.

The new study, conducted by Synergy Sports, a company with 15 years of experience building sports complexes, was presented to the Palm Coast City Council at the Feb. 13 workshop meeting by owner Jason Boudrie. Including overnight stays, day-trippers and indirect spending, Boudrie said the facility's economic impact could range from $79 million in its first year to $154 million by year 10.

Most importantly, he said, the facility would have a revenue excess of almost $500,000 from its first year of operations and after its first year’s leaseback payment.

“We determined, through our financial modeling, that the revenue of the facility can support its operating expenses,” he said. “That's a very big deal.”

This is different from the study conducted by the Sports Facilities Companies last December. That presentation estimated only $30 million in economic impact in the facility's first year and that the facility would run at a deficit for the first two years until it gained more traction.

Assistant City Manager Lauren Johnston said in an interview with the Observer that the previous study did not account for all the spending a facility of that size would generate.

Boudrie, like Sports Facilities Companies, recommended the city look for a private-public partnership to fund the project, which he referred to as a “P3.”

Synergy has 15 years of experience building facilities like this all over the country and has even recently completed work on a smaller facility in Alachua County, the Alachua County Sports and Events Center.

The key difference between the two companies, Johnston said, is that Synergy helps find the private partners, while Sports Facilities does not.

“It’s not that we’ve totally you know, knocked out Sports Facilities Company,” Johnston said, “but [Synergy] opened different doors by saying, hey, we know how to kind of get these [partnerships.]”

Synergy’s proposed complex would cost $93 million but would be funded through a public-private partnership, Boudrie said.

The way it would work, Boudrie said, is the city leases the land to the developer for a one-time, low fee — like $1, he said — and the developer would then build the facility. The city then pays off the cost of the project through the lease over a set term.

“[The lease fee] is ceremonial,” Boudrie told the Observer. “There has to be a transaction.”

The city would only be responsible for pre-development costs, like identifying what land to use for the facility, he said.

Boudrie said a city that reinvests its excess revenue into the lease can pay off the lease in 17 years. The $93 million price tag is the same cost as what was proposed by Sports Facilities Companies.

A P3 doesn’t put the financial onus on the city, Johnston said.

“We don't have $90 million to go build this,” she said. But the city wants the amenity and need the additional fields.

Instead, the city needs to consider if it wants to commit itself to such a long-term lease, she said.

With Palm Coast’s heavy dependence on property taxes to fund its operations, a facility like this would bring in much-needed economic diversity, she said. And facilities like these are also more-or-less recession-proof, Johnston said.

“Parents aren't going to stop taking their kids to do things,” she said. “They find whatever way that they can in order to, you know, give their children opportunities.”

Parents aren't going to stop taking their kids to do things. They find whatever way that they can in order to, you know, give their children opportunities.”

— LAUREN JOHNSTON, assistant city manager

Boudrie agreed.

“We found that true during COVID,” he said. “Anecdotally, parents will spend money for their kids.”

Likewise, a P3 has less drawbacks, he said — it doesn’t impact the city’s credit solvency, nor does it take away from the city other financial resources to fund, while keeping the facility accessible to residents.

If a partnership would fail, Boudrie said, it would be because the facility is not making revenue or because the municipality does not pay the leaseback payments.

In the former case, the city would need to use its general revenue to pay the leaseback payment, he said. If the latter, the facility would go back to the investor group, who would run it until it received a return on its investment.

But in his 15 years building facilities like this, he said, he’s never had a public-private partnership fail.

“We don't make this recommendation for this leaseback unless we're confident enough in the numbers to bring our partners into it,” Boudrie said.

We don't make this recommendation for this leaseback unless we're confident enough in the numbers to bring our partners into it."

— JASON BOUDRIE, owner of Synergy Sports

Management for the facility would stay with the operator, even after the leaseback is paid off, instead of turning over to Parks and Recreation for day-to-day management. The revenue of the facility will return to the city, Boudrie said.

“There's no money out of pocket from the city, other than the pre-development costs,” he said.

Synergy reviewed Sports Facilities Companies original proposal and recommended several changes to better suit demand.

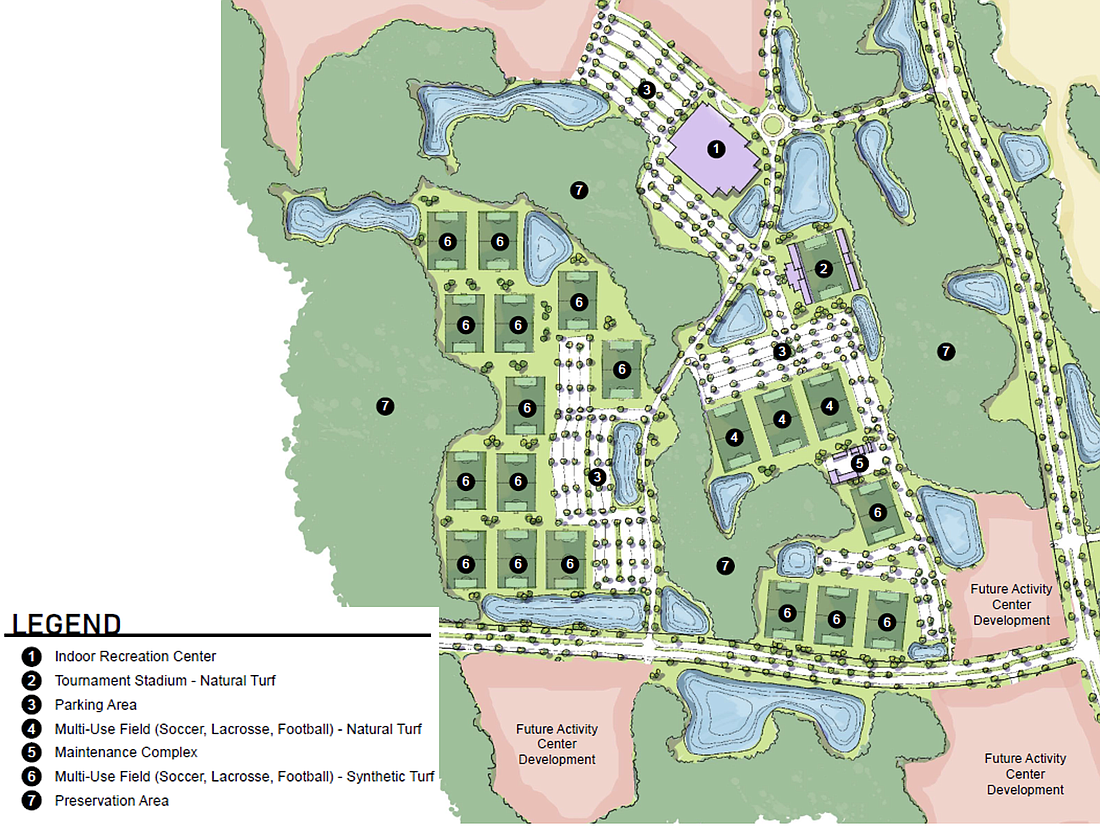

Johnston said the city looked at land on the west side of Highway U.S. 1 to plan the concept. Sports Facilities Companies’ concept was more localized on the acreage, while Synergy, she said, and city staff, instead worked with the land for a more natural design.

Sports Facilities Companies recommended 20 fields, which Synergy kept. Synergy recommended 16 synthetic turf, multi-use fields, three natural grass fields, several large preservation areas and one natural-turf stadium.

Sports Facilities Companies recommended a 112,000-square-foot indoor facility with eight basketball courts, 16 volleyball courts, meeting spaces, and flex and support spaces.

Older facilities — basic soccer complexes where there's just a bunch of fields and no real amenities — will tend to begin to start losing to a facility like this, because there's it's a better visitor experience."

— JASON BOUDRIE, owner of Synergy Sports

Boudrie said that may not be enough to support larger tournaments. He recommended instead a 140,000-square-foot indoor facility to support other leasing options and larger tournaments.

Boudrie told the Observer that a facility this size would be unique in Florida — while there are other, smaller facilities, he said, there are no facilities that could serve national or super-regional, larger-scale tournaments.

“Older facilities — basic soccer complexes where there's just a bunch of fields and no real amenities — will tend to begin to start losing to a facility like this, because it's a better visitor experience,” he said.

The facility would be open for residents to use, with most tournaments taking place on the weekends. Several spaces in the concept design have also been identified for retail and commercial use, including hotels.

In a timeline, once a shovel goes in the ground, Boudrie said, it would take between 18-24 months to complete.

If we're changing the face of our community, and wanting to be a more multi-generational, family driven community, then these are these are tools that help build that community."

— LAUREN JOHNSTON, assistant city manager

If this project moves forward and the city does eventually enter into a partnership, Johnston said, the city will need to potentially make a change to the city charter.

“The city has never entered into a public-private partnership like this before,” Johnston said.

The city’s charter currently limits unfunded leases like this to a three-year lease, or a maximum of $15 million. As well, partnerships are outlined in state statutes, she said, so the city must follow those legal processes.

Mayor David Alfin asked Boudrie to return with more information on the how a facility like this facilitates athletic scholarships for local students and the ways medical services could be of use at the complex as well, mentioning Palm Coast's growing health care services industries.

For now, the City Council has authorized Johnston and staff to continue moving forward with finding a partnership.

Johnston said the potential economic impact for the community is worth pursuing.

“If we're changing the face of our community, and wanting to be a more multi-generational, family driven community, then these are these are tools that help build that community,” Johnston said.