- December 20, 2024

-

-

Loading

Loading

TALLAHASSEE — After a flurry of last-minute votes on bills, Florida lawmakers on Friday, March 8, passed a $117.46 billion state budget and ended the 2024 legislative session.

House Speaker Paul Renner, R-Palm Coast, and Senate President Kathleen Passidomo, R-Naples, gaveled the 60-day session to a close at 2:25 p.m., before going to the rotunda between the House and Senate for a traditional hanky-drop ceremony.

Renner and Passidomo touted the Legislature’s accomplishments as they prepare to end two-year terms leading the House and Senate.

“Again and again, we have looked at the real needs of real Floridians and delivered time and time again because of the men and women behind me who chose collaboration over competition,” Renner, flanked by lawmakers, said after the hanky drop. “I am very proud of what we’ve accomplished, and we have accomplished it together. We delivered for Florida.”

But House Minority Leader Fentrice Driskell, D-Tampa, described this year’s session as being about “missed opportunities.”

“It really seems to me like the Republicans are turning a blind eye and a deaf ear to Floridians who are in crisis right now,” Driskell said.

The budget, which remains subject to line-item vetoes by Gov. Ron DeSantis, will take effect with the July 1 start of the 2024-2025 fiscal year. The Senate voted 39-0 to approve the budget, after the House passed it in a 105-3 vote. The budget for the current fiscal year, which started July 1, totaled $119.1 billion.

Speaking on the House floor Friday, House Appropriations Chairman Tom Leek, R-Ormond Beach, cited issues such as the budget including a $1.8 billion increase in the Florida Education Finance Program, the key funding source for public schools. Also, he gave examples such as an 8 percent increase in Medicaid funding for nursing homes and no tuition increases for state college and university students.

“This budget is on time, it’s balanced and it’s lean, and it supports every Floridian that we’ve got,” Leek said.

Leek and Senate Appropriations Chairman Doug Broxson, R-Gulf Breeze, finished budget negotiations on March 4, readying the spending plan for the March 8 vote. One late addition to the plan was a proposal, backed by DeSantis, that will bring back a bill-credit program for frequent toll-road users.

The program, which was in place in 2023, would begin again April 1 and provide 50 percent credits to motorists who make 35 or more toll-road trips a month. It could cut state revenue by about $450 million.

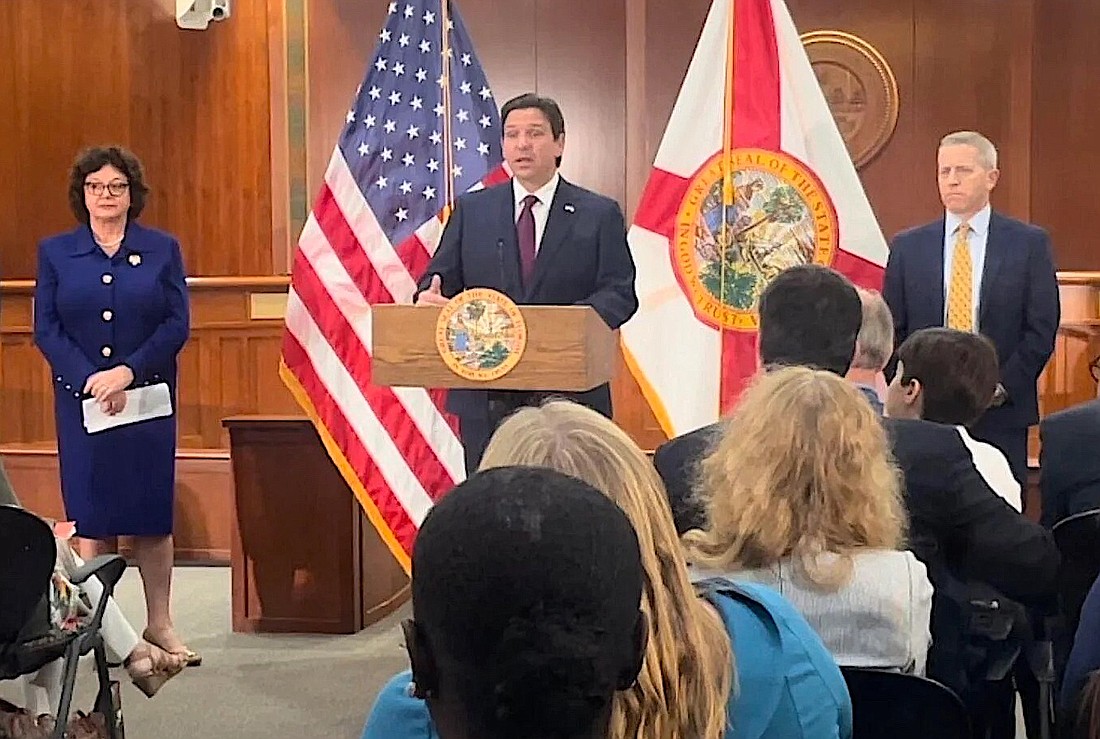

“The tolls was something I was really fighting for, just because I got a lot of good feedback on it,” DeSantis said during a news conference with Renner and Passidomo after the session ended. “People appreciated it, especially if you're spending $50 to $100 a month.”

Lawmakers on Friday also passed a related tax package that would provide about $439.6 million in tax breaks during the upcoming year. The package includes such things as a series of sales-tax “holidays” and providing tax credits on property-insurance policies.

As happens at the end of virtually every legislative session, the House and Senate spent the final days — and hours — of this year’s session lobbing bills and amendments back and forth.

For example, the Senate last week amended a human-trafficking bill (HB 7063) to prevent strippers under age 21 from working in adult-entertainment establishments. That sparked a debate Friday morning when the amended bill came back to the House for final consideration.

Rep. David Borrero, R-Sweetwater, said sex trafficking can take place in strip clubs.

“It’s common sense,” Borrero said. “We ought to be on the side of young girls who are barely legal.”

But Rep. Michele Rayner, D-St. Petersburg, said lawmakers should not “legislate values” and that young women would be pulled into working at private parties if they are barred from strip clubs.

“This is just another way for women to be controlled,” said Rayner, who nevertheless voted for the bill, which passed 104-3.

The News Service of Florida Assignment Manager Tom Urban and staff writers Jim Turner and Ryan Dailey contributed to this report.